|

|

Order by Related

- New Release

- Rate

Results in Title For loan repayment grid

| Calculate your home loan repayment and experiment with different options to reduce your total payment such as reducing years, increasing payment, once-off and irregular payments .. |

|

| Online Loan Repayment Calculator. Loan repayment calculation through web interface. No additional software instead of your web browser is required. You may use any browser you like: Internet Explorer, Mozilla Firefox etc. Simply enter the required values into the appropriate fields at the top and then press the button to calculate the repayment amount. ..

|

|

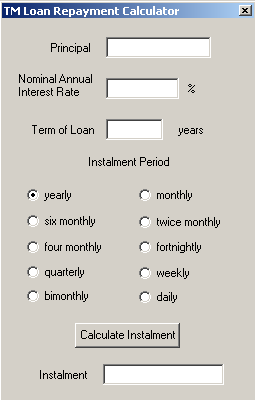

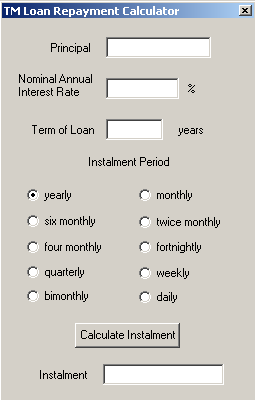

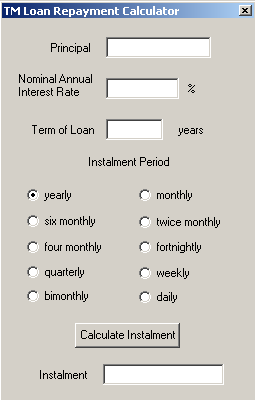

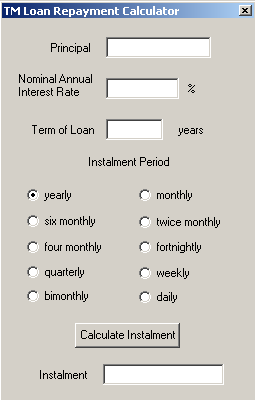

| Desktop Loan Repayment Calculator. Loan repayment calculation for your personal computer. .. |

|

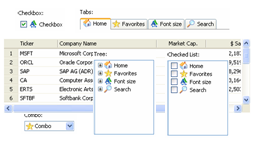

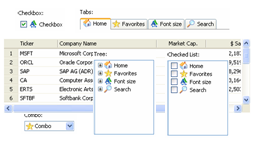

| Sigma Grid is a Ajax-enabled JavaScript grid control that provides professional solution for representing and editing tabular data on the web.

Pure javascript codes, Seamless Integration with any server side solution, such as j2ee, .net, PHP, perl.

Inline editing, keyboard data navigation, nested multiline headers, sortable and frozen columns.

Slice rendering and built-in paginal output allow you to manipulate huge datasets on the fly.

Powerful aggregation by group and printing technology, to make it easy to build a traditional-look printable reports.

OGNL format supported, smooth objects converting between presentation layer and logic layer.

Extensibility enable you to replace built-in cell editor with custom external component (user defined editor), present cell data as your customers' wish (user defined renderer).

Plentiful attibutes and event handlers give you more flexibility without coding too much.

Export and import in CSV / XML / JSON format, to support further editing within spreadsheet or any other applications. ..

|

|

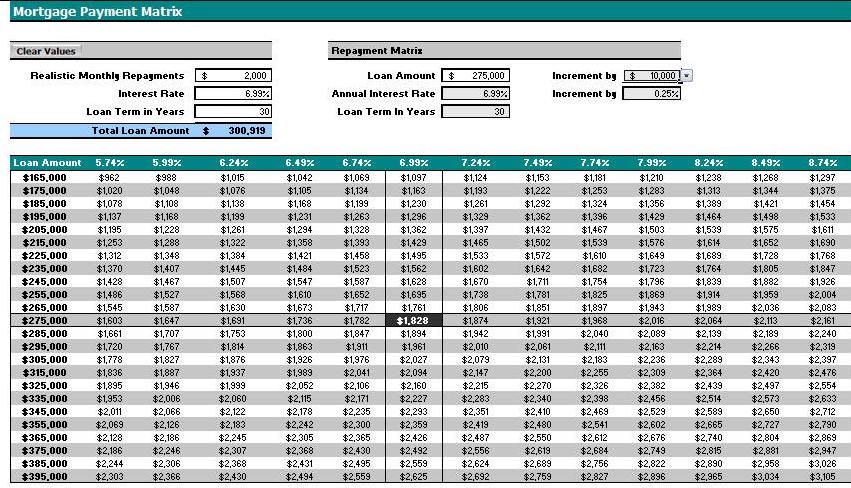

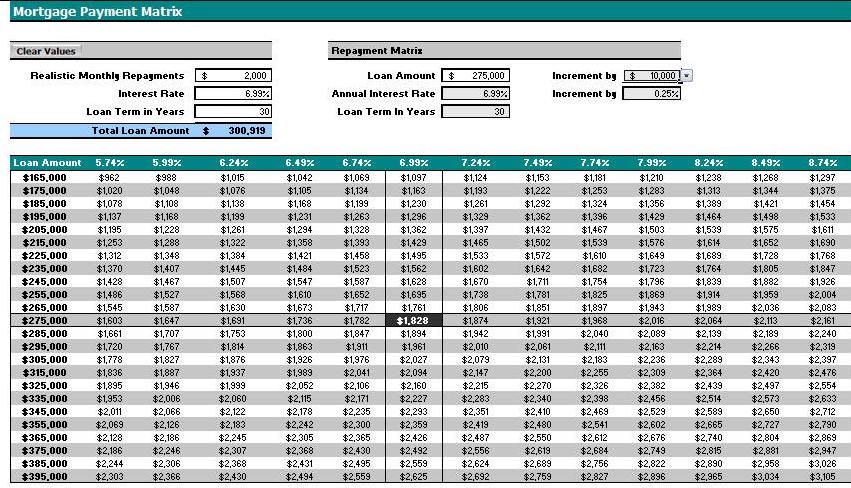

| Calculate your mortgage repayments and how much you can realistically borrow. Mortgage matrix that shows what your repayments will be if you borrowed more or less and changes in interest rates. .. |

|

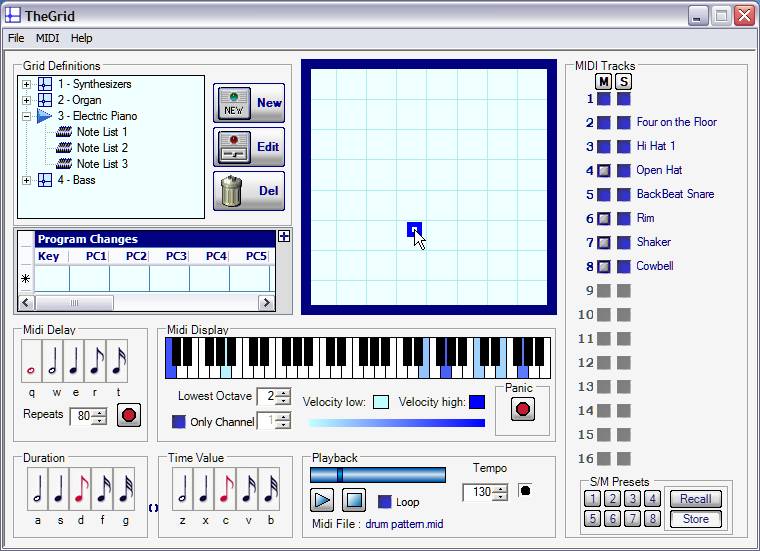

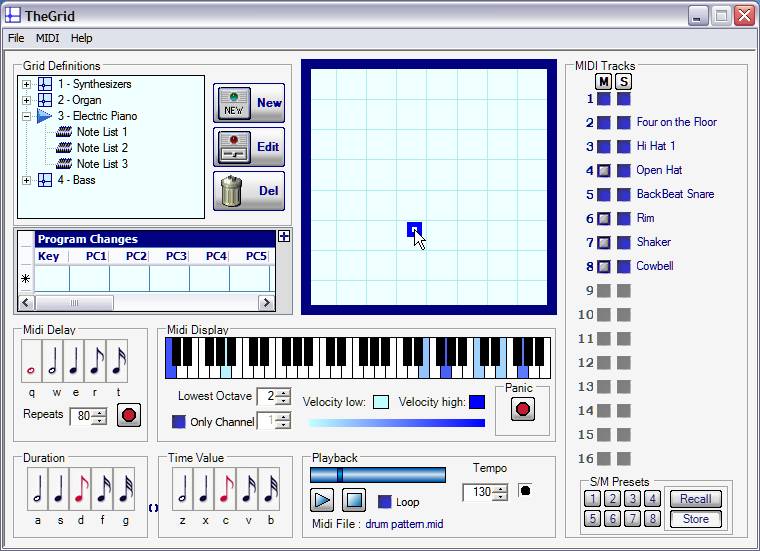

| TheGrid is unlike any Midi software program you have ever used. TheGrid turns the controllers you already have on your computer (keyboard and wheel mouse) into a very expressive and unique Midi controller. ..

|

|

| Free Grid ActiveX Component. .. |

|

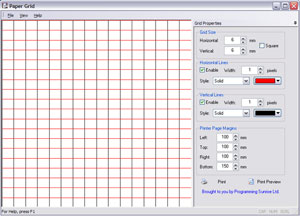

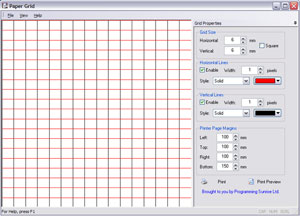

| Design and print on paper grids of any size and style - configure horizontal and vertical lines separately (you can turn them on and off) as well as page margins. .. |

|

| RexpinTM:Off The Grid is a "match-3" game with a twist! Swap symbols connected by "powerlines" to match-3. Match a flashing bonus symbol and earn extra game time. 20 levels of play. .. |

|

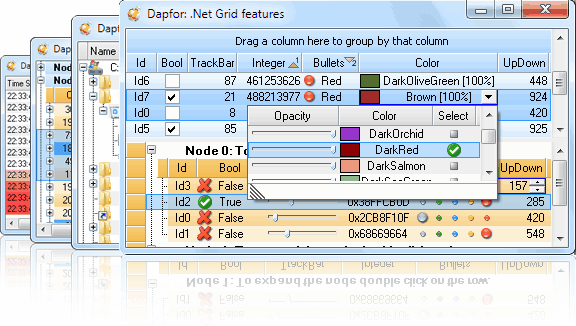

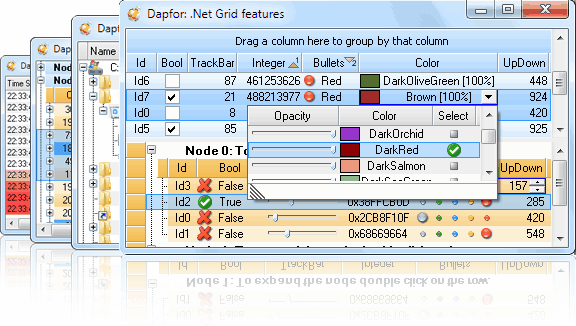

| .Net Grid. Hierarchical data binding, drag&drop, grouping, serialization, cell editors, custom drawing, cell tooltips, threadsafety. Realtime filtering, regrouping, multiple sorting, cell highlighting. Performance: 50000 upd/sec, 16MB/100000 rows .. |

|

Results in Keywords For loan repayment grid

| Desktop Loan Repayment Calculator. Loan repayment calculation for your personal computer... |

|

| Online Loan Repayment Calculator. Loan repayment calculation through web interface. No additional software instead of your web browser is required. You may use any browser you like: Internet Explorer, Mozilla Firefox etc. Simply enter the required values into the appropriate fields at the top and then press the button to calculate the repayment amount...

|

|

| Quick and fun freeware tool to get powerful perspective on credit card debt. Talk about motivation! Crusher will show you exactly how much Home, Car or Retirement you re giving up for the privilege of carrying debt! Try it, it s fun and profound!.. |

|

| Credit-Repair-Planner helps create an credit-improvement-optimized repayment schedule. The concept is simple: pay the highest-interest cards first while bearing in mind that carrying over 50% on any credit line dings your credit score...

|

|

| Calculating the repayments for your mortgage is a very important business. You have to get into a level that will allow you to keep up your repayments even if things don't go quite as well for you with regard to your personal finances as you might hope. Being able to see a layout of your full payment schedule for the entire length of your mortgage can be a huge help when deciding what level you are comfortable with.

The real mortgage news simple mortgage calculator will allow you to do just this. All you have to do is enter the anticipated price of your house, your deposit, interest rate and length of mortgage and the calculator will do the rest. This will allow you to see your full repayment schedule as you already know seeing something in print will give you a much clearer idea of whether you are heading in the right direction in terms all the level of repayment schedule that you are considering. If you wish to look at all the scenarios simply adjust any of the figures in the boxes and this will allow you to compare your repayment schedules in terms of burying the length, varying the deposit or considering houses in a slightly different price bracket.

Buying your own home is a massive financial undertaking so whether this is your first home or whether you are ready to upgrade the calculations you do now will be vital with regard to your financial future. We hope you enjoy this simple mortgage calculator. also, if you are not using a Windows-based operating system there are also calculators available at realmortgagenews.com that will work with virtually any other operating system... |

|

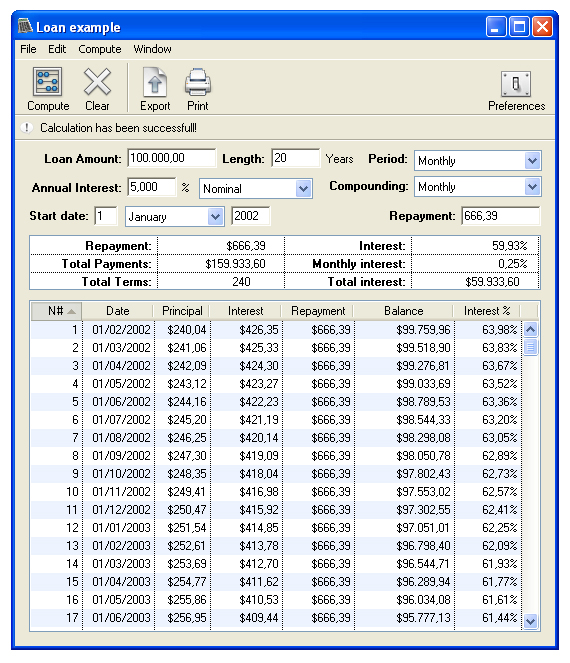

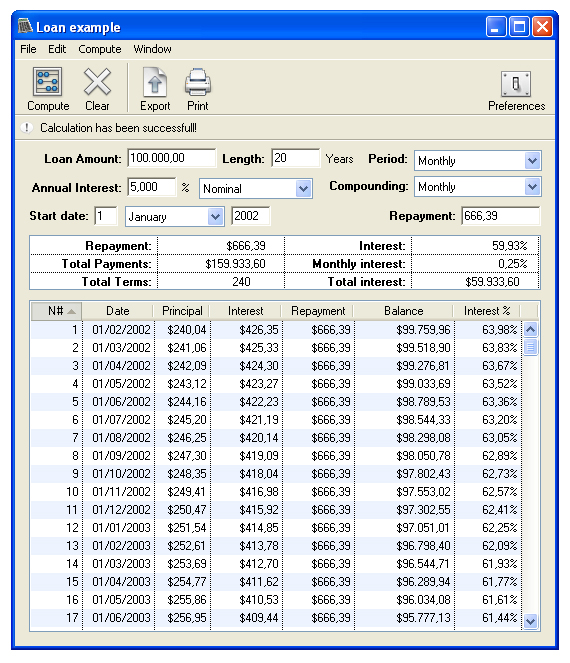

| Before taking out a loan of any kind, it's very important to examine the repayment schedule and how that will impact upon you over the full term of the loan. You also need to look at this from the point of view of what might happen if you come under pressure in terms of your income. Nowhere is this more applicable than in the case of a line of credit where you use home equity to secure a lower interest rate.

If you've ever had any difficulty in the past which are credit rating than this type of loan where you secure the debt using the equity in your home can be a very attractive type of financial product. It's also very important to understand that if you default on the payments with this type of loan that you may finish up losing your home. That's why it's very important that you look at any of the problems that may arise before hand. If you have had difficulties which are credit rating in the past you need to ask yourself how you got into that situation and have things changed significantly since then.

That's why it's extremely important to be able to lay out the repayments and look at the different scenarios where you very the interest rate etc.

This calculator is extremely easy to use. It's also very easy to install. It will run on any existing version of Windows and is also been optimized to run on older computers to give the widest possible compatibility. All you have to do to use the calculator is input your loan amount, number of years and the interest rate. You will then be able to assess exactly what you're repayment schedule will be over the full term of your loan.

It's advisable to run several different sets of numbers as this will allow you to assess how a different interest-rate would affect the repayment schedule on an ongoing basis. Because this calculator runs very quickly it will allow you to go through several different sets of scenarios which will allow you to make the best decision possible...

|

|

| The Budget Planner V3 Pro is a step ahead for home and personal budgeting. Equipped with a comprehensive online learning system, the budget planner runs on auto pilot, you simply add the details and the software will run your budget for you to learn from or live by! Features include a loan and mortgage calculator with 'what-if' multiple scenario planning. Using the compounded interest formula, where the interest is calculated on the monthly balance of the loan, the loan and mortgage calculator performs multiple queries based on your loan, loan term, interest rate and repayment options. Multiple Scenarios option: Based on three different scenarios on a static loan amount, this option allows you to view these scenarios based on varying interest rates and repayment options. Multiple Plan option: Based on the Multiple Scenarios option, this function allows you to have Plan A, Plan B, and Plan C. Each plan may have a different loan amount or you can choose to have the same repayments, loan term and interest rate, or vary all of these functions to provide you with 9 different scenarios. The loans and savings target goal tracker - How your loan affects your home finances. The Loan Tracker will automatically adjust your budget plan according to your loan requirements and repayment options. Savings Calculator and Savings Target Date - Have a target date for your next holiday or purchase? All you need to enter is how often you want to put money aside and the Savings Calculator automatically adjusts your budget for you and re-adjusts when you reach your target date. Due-dates and reminders chart - Add notes, reminders and due dates to your Income and Expense Items. Includes auto-notification facility, notes, reporting and graph modelling, internal web browser, context sensitive online help, auto store functionality and a fully customizable categories menu. Real budgeting, real returns!.. |

|

Results in Description For loan repayment grid

| Before taking out a loan of any kind, it's very important to examine the repayment schedule and how that will impact upon you over the full term of the loan. You also need to look at this from the point of view of what might happen if you come under pressure in terms of your income. Nowhere is this more applicable than in the case of a line of credit where you use home equity to secure a lower interest rate.

If you've ever had any difficulty in the past which are credit rating than this type of loan where you secure the debt using the equity in your home can be a very attractive type of financial product. It's also very important to understand that if you default on the payments with this type of loan that you may finish up losing your home. That's why it's very important that you look at any of the problems that may arise before hand. If you have had difficulties which are credit rating in the past you need to ask yourself how you got into that situation and have things changed significantly since then.

That's why it's extremely important to be able to lay out the repayments and look at the different scenarios where you very the interest rate etc.

This calculator is extremely easy to use. It's also very easy to install. It will run on any existing version of Windows and is also been optimized to run on older computers to give the widest possible compatibility. All you have to do to use the calculator is input your loan amount, number of years and the interest rate. You will then be able to assess exactly what you're repayment schedule will be over the full term of your loan.

It's advisable to run several different sets of numbers as this will allow you to assess how a different interest-rate would affect the repayment schedule on an ongoing basis. Because this calculator runs very quickly it will allow you to go through several different sets of scenarios which will allow you to make the best decision possible... |

|

| The Budget Planner V3 Pro is a step ahead for home and personal budgeting. Equipped with a comprehensive online learning system, the budget planner runs on auto pilot, you simply add the details and the software will run your budget for you to learn from or live by! Features include a loan and mortgage calculator with 'what-if' multiple scenario planning. Using the compounded interest formula, where the interest is calculated on the monthly balance of the loan, the loan and mortgage calculator performs multiple queries based on your loan, loan term, interest rate and repayment options. Multiple Scenarios option: Based on three different scenarios on a static loan amount, this option allows you to view these scenarios based on varying interest rates and repayment options. Multiple Plan option: Based on the Multiple Scenarios option, this function allows you to have Plan A, Plan B, and Plan C. Each plan may have a different loan amount or you can choose to have the same repayments, loan term and interest rate, or vary all of these functions to provide you with 9 different scenarios. The loans and savings target goal tracker - How your loan affects your home finances. The Loan Tracker will automatically adjust your budget plan according to your loan requirements and repayment options. Savings Calculator and Savings Target Date - Have a target date for your next holiday or purchase? All you need to enter is how often you want to put money aside and the Savings Calculator automatically adjusts your budget for you and re-adjusts when you reach your target date. Due-dates and reminders chart - Add notes, reminders and due dates to your Income and Expense Items. Includes auto-notification facility, notes, reporting and graph modelling, internal web browser, context sensitive online help, auto store functionality and a fully customizable categories menu. Real budgeting, real returns!..

|

|

| Loan Calc is an easy-to-use tool intended to calculate loans and mortgages repayments in a very simple way. Loan Calc calculates repayments amount, monthly and total interest, total repayments and generates a full repayment list from a start date... |

|

| Canadian Loan Spread Calculator Pro gives you a unique perspective on borrowing money. It automatically displays financial answers on a two dimension grid as you enter or update loan variables...

|

|

| Loan Advisor for Excel is a special loan toolbox with many loan calculators for users who need a tool to establish and compare different loan options. This powerful set of calculators will help you in many loan calculations and determine the better loan for you... |

|

| Find great rates on a flexible loan from here. Apply online and use our free quote service, and let us find the best loans for you! Just click on the button below and complete our easy application form. There is no obligation and there is no charge for our service. Find the right loan now by simply completing our quick and easy enquiry form. Let us do the work for you! We have access to all the lenders, some of which offer loans with flexible terms. In some cases payment holidays are allowed, and overpayments can be made without penalty. We can take the guesswork out of applying for a flexible loan, by using our industry experience, we will always find the right loan for you! Through our services you can borrow in between $3000 and $25000 as unsecured loans that depend on your requirement, your credit record and your repayment ability. You can easily repay the loan according to your convenience. We have long term unsecured loans program in which you can repay the loan within 7-10 years. So what for are you waiting? Fill our no obligation online application form at our website NOW.* Friendly advice is available from our loan advisers * But you have make the conscious decision to pay your bills on time or we don't want to deal with you. It's that simple. * Don't let bankruptcy, liens, divorce, charge offs, etc. stop you from getting a loan. * We can help you find a business loan and start a business..

|

|

| LoanAnalyst helps professionals as well as individual loan seekers analyze the various loan parameters to make an informed loan decision. Packed with several powerful loan analysis features, ability to send loan information via SMS, and save Loans... |

|

| Calculate your home loan repayment and experiment with different options to reduce your total payment such as reducing years, increasing payment, once-off and irregular payments.. |

|

| All purpose loan calculator program that handles all common calculations related to securing and paying for loans. Contains loan calculator that solves for missing values (payment, interest rate,term, balance, loan amount) Also develops amortization schedules, allows accelerated amortization, has refinancing, loan comparison and loan qualification modules. W9X/NT/2000. Shareware. .. |

|

| Compare 135 loans at once with LoanSpread Loan Comparison Calculator and drill down into a loan summary of any of the 135 you choose. Displays answers of loan amounts, interest rates, terms in months, or payment amounts based upon your loan variables.. |

|

Results in Tags For loan repayment grid

| Calculate your home loan repayment and experiment with different options to reduce your total payment such as reducing years, increasing payment, once-off and irregular payments.. |

|

| Online Loan Repayment Calculator. Loan repayment calculation through web interface. No additional software instead of your web browser is required. You may use any browser you like: Internet Explorer, Mozilla Firefox etc. Simply enter the required values into the appropriate fields at the top and then press the button to calculate the repayment amount...

|

|

| Desktop Loan Repayment Calculator. Loan repayment calculation for your personal computer... |

|

| SourceGrid 1.2.11.0 is a light grid control written in C# that will allow programmers to add basic grid capabilities to their .NET Windows Forms applications. Apps using the control can display and edit unbound data. The author feels that the DataGrid class of Microsoft..

|

|

| Loan And Mortgage is a loan amortization schedule calculator that handles virtually any loan type. This program is user-friendly, flexible and loaded with useful features that show you where to recover or save money instantly! An absolute 'Must See!'.. |

|

| AAA EasyGrid Activex has exceedingly powerful functions, much more powerful than other grid or report OCXes, such as FlexGrid, Crystal Report, Formual One, Spread and so on. AAA EasyGrid ActiveX can do form control such as edit, input, print, print..

|

|

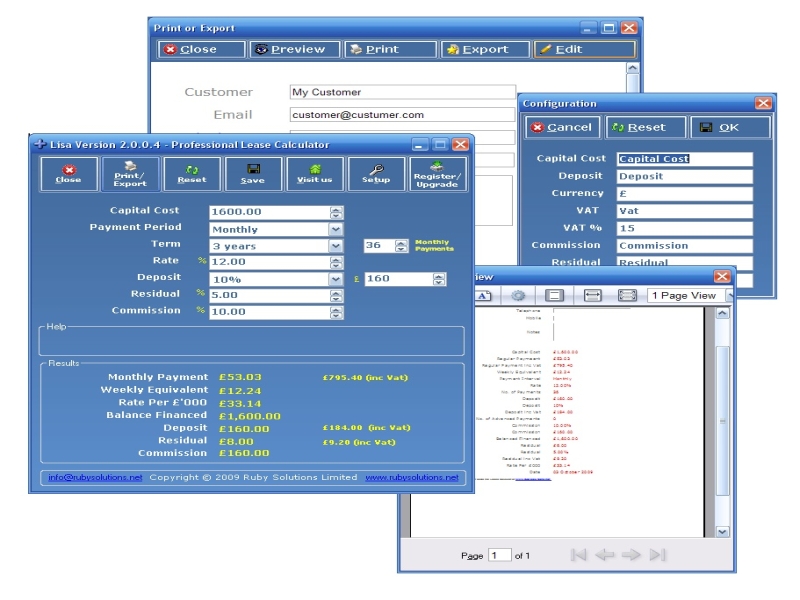

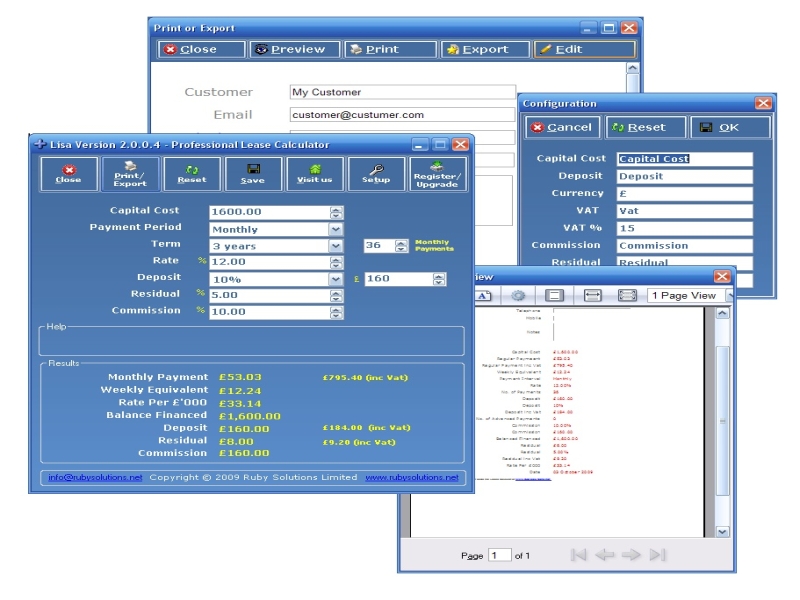

| Free Lease finance calculator for the Leasing Professional. Simple to use, but comprehensive, Lisa is an excellent tool for quoting rapid and accurate lease finance repayments. Speeds up the routine and simplifies the more complex lease calculations.. |

|

| Make your most demanding users happy with the fast and reliable cross-browser data grid component. Complete with fixed headers, client-side sorting, resizable columns, images, tooltips and a lot more - the grid widget will save you weeks of JavaScript/DHTML/CSS/XML programming. Professional design, well documented source code, tutorial, API reference, examples, active support community. All that for free (GPL)... |

|

| Mrtgcalc is an easy-to-use loan calculator allowing users to analyse and manage all types of loans including but not restricted to mortgage loans, home loans, auto car lease loans and student loans. Mrtgcalc supports lease loans and includes the much-awaited Loan Amount calculator, Interest Rate calculator, and Loan Term calculator alongside the popular Monthly Payment calculator.

Users can enter, edit and store unlimited numbers of loan calculations. For each loan, Mrtgcalc will show the Monthly Payment, the Cost of Loan and a full Amortization breakdown detailing the Capital Paid, Interest Paid, Outstanding Loan Balance, Total Capital to date and Total Interest Paid to date for each month, whilst allowing capital repayment scenarios to be entered and providing save/restore facilities.

Other FIS Windows CE Products include:-

1) Genesis - Technical Analysis & Charting System,

2) PortMgr - Investment Portfolio Manager,

3) pFXcalc - Currency Calculator,

4) Optcalc - Options Calculator,

5) Futcalc - Futures Calculator.

This version supports Pocket PC, Pocket PC 2002 and Pocket PC 2003 devices. For further information and free trial versions for other CE devices, such as Handheld PC & HPC 2000, please visit:-

www.fis-group.com/palmtop.htm.. |

|

| The java Data Grid Control applet enables the display of data in rows & columns in java & web applications. Powerful features include Fast Sorting, Data Acquisition, URL Hyperlinks, Embedded Images, Column Totalling and much more... |

|

Related search : oan repaymentrepayment calculatoronline loan,online loan repaymentloan repayment calculatorcalculator online loanrepayment calculator onlineloan repayment,loan repayment calculatordesktop loan repayment,ensuing resultsloan and,ensuing results abilityOrder by Related

- New Release

- Rate

repayment agreement -

repayment period -

debt repayment plans -

mortgage repayment calculator -

buy let mortgage repayment -

|

|