|

|

Order by Related

- New Release

- Rate

Results in Title For repayment agreement

Results in Keywords For repayment agreement

| A Residential Lease Agreement is used by a landlord to rent a rental property to a tenant. Also available is commercial lease agreement, sublease agreement and eviction notices... |

|

| Commercial lease agreement is used by a landlord to rent a commercial property to tenant..

|

|

| Provides an instant list of tactics for solving common negotiation, persuasion and conflict resolution problems. Win is the first software that tells you how to be more persuasive. It helps you communicate, sell, negotiate and create agreement. Utilizing the most comprehensive collection of tactics in existence, Win analyzes the unique facts of your situation and provides custom advice tailored to your style, goals and level of assertiveness.

Win Gives You The Power To:

Communicate Persuasively

Reach Agreement Faster

Negotiate Better Deals

Close More Sales

Get Better Terms Resolve Conflict

Debate Effectively

Influence Others

Build Consensus

Train Your Staff

Win contains more than 600 tactics for selling ideas, creating agreement and influencing opinion. Win takes motivations, interests, personality and levels of assertiveness into account to fashion the most persuasive approach possible. Using the fundamental principles of supply and demand to identify each party's strengths and weaknesses, Win analyzes a wide variety of subjects - from personal disputes to business conflict.

Win will recommend an overall approach or target narrow issues such as time, information, impasse or ethics. You can obtain ideas in less than a minute or spend 30-45 minutes preparing a thorough plan. Win also predicts the other party's responses to your tactics and recommends defenses to their tactics.

Win is an excellent tool for practicing your negotiation and persuasion technique. Unlike books and seminars, Win analyzes the unique facts of your situation and provides expert advice where you are and when you need it. Whether you are selling products, services or ideas, Win will help you find the most effective approach. Whether you believe in win-win, or just winning, Win will help you find the most successful tactics... |

|

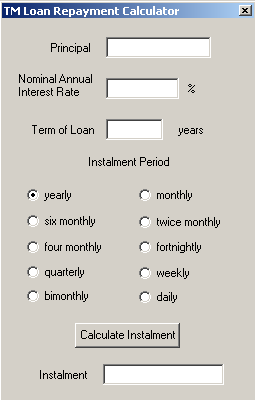

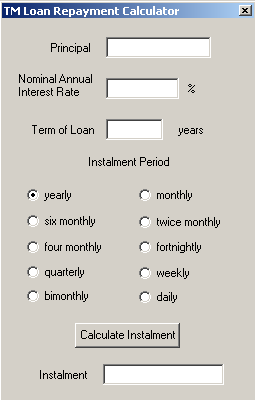

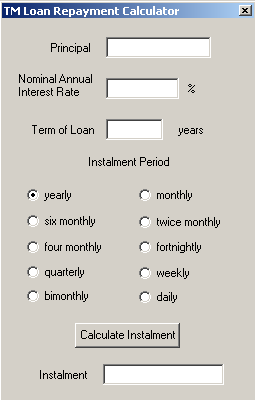

| Desktop Loan Repayment Calculator. Loan repayment calculation for your personal computer...

|

|

| Online Loan Repayment Calculator. Loan repayment calculation through web interface. No additional software instead of your web browser is required. You may use any browser you like: Internet Explorer, Mozilla Firefox etc. Simply enter the required values into the appropriate fields at the top and then press the button to calculate the repayment amount... |

|

| Quick and fun freeware tool to get powerful perspective on credit card debt. Talk about motivation! Crusher will show you exactly how much Home, Car or Retirement you re giving up for the privilege of carrying debt! Try it, it s fun and profound!..

|

|

| Credit-Repair-Planner helps create an credit-improvement-optimized repayment schedule. The concept is simple: pay the highest-interest cards first while bearing in mind that carrying over 50% on any credit line dings your credit score... |

|

| Business and Personal Legal Forms & Contracts including Bill of sale, power of attorney, lease agreements and notices, promissory note, release agreement, sales and contractor agreement, prenuptial agreement, last will & testament and living will... |

|

| Calculating the repayments for your mortgage is a very important business. You have to get into a level that will allow you to keep up your repayments even if things don't go quite as well for you with regard to your personal finances as you might hope. Being able to see a layout of your full payment schedule for the entire length of your mortgage can be a huge help when deciding what level you are comfortable with.

The real mortgage news simple mortgage calculator will allow you to do just this. All you have to do is enter the anticipated price of your house, your deposit, interest rate and length of mortgage and the calculator will do the rest. This will allow you to see your full repayment schedule as you already know seeing something in print will give you a much clearer idea of whether you are heading in the right direction in terms all the level of repayment schedule that you are considering. If you wish to look at all the scenarios simply adjust any of the figures in the boxes and this will allow you to compare your repayment schedules in terms of burying the length, varying the deposit or considering houses in a slightly different price bracket.

Buying your own home is a massive financial undertaking so whether this is your first home or whether you are ready to upgrade the calculations you do now will be vital with regard to your financial future. We hope you enjoy this simple mortgage calculator. also, if you are not using a Windows-based operating system there are also calculators available at realmortgagenews.com that will work with virtually any other operating system... |

|

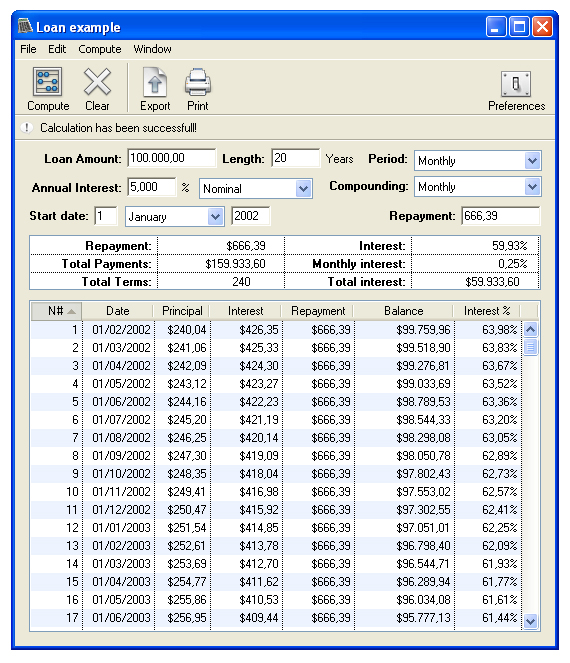

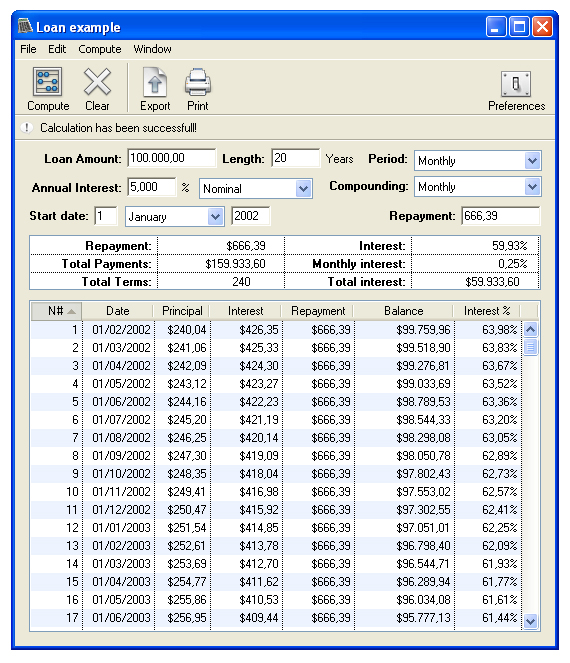

| Before taking out a loan of any kind, it's very important to examine the repayment schedule and how that will impact upon you over the full term of the loan. You also need to look at this from the point of view of what might happen if you come under pressure in terms of your income. Nowhere is this more applicable than in the case of a line of credit where you use home equity to secure a lower interest rate.

If you've ever had any difficulty in the past which are credit rating than this type of loan where you secure the debt using the equity in your home can be a very attractive type of financial product. It's also very important to understand that if you default on the payments with this type of loan that you may finish up losing your home. That's why it's very important that you look at any of the problems that may arise before hand. If you have had difficulties which are credit rating in the past you need to ask yourself how you got into that situation and have things changed significantly since then.

That's why it's extremely important to be able to lay out the repayments and look at the different scenarios where you very the interest rate etc.

This calculator is extremely easy to use. It's also very easy to install. It will run on any existing version of Windows and is also been optimized to run on older computers to give the widest possible compatibility. All you have to do to use the calculator is input your loan amount, number of years and the interest rate. You will then be able to assess exactly what you're repayment schedule will be over the full term of your loan.

It's advisable to run several different sets of numbers as this will allow you to assess how a different interest-rate would affect the repayment schedule on an ongoing basis. Because this calculator runs very quickly it will allow you to go through several different sets of scenarios which will allow you to make the best decision possible... |

|

Results in Description For repayment agreement

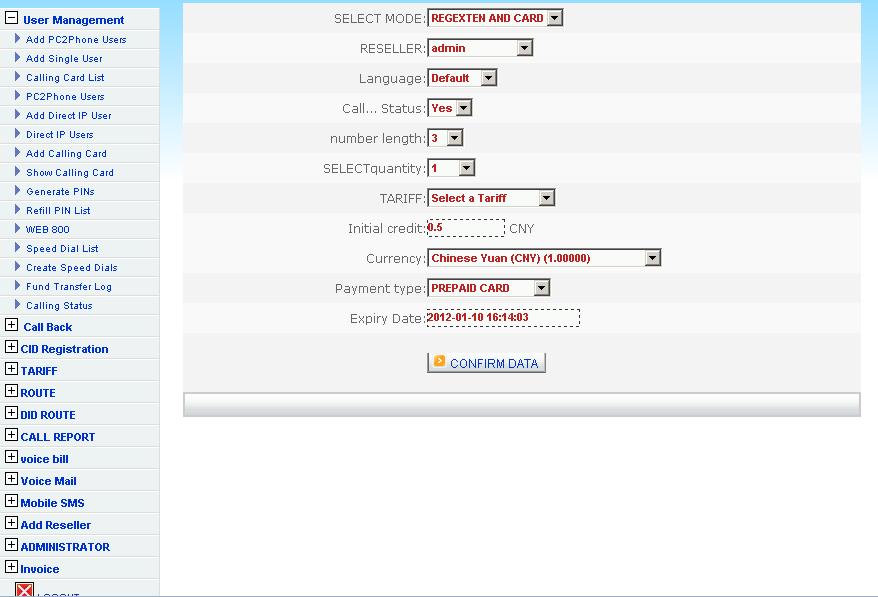

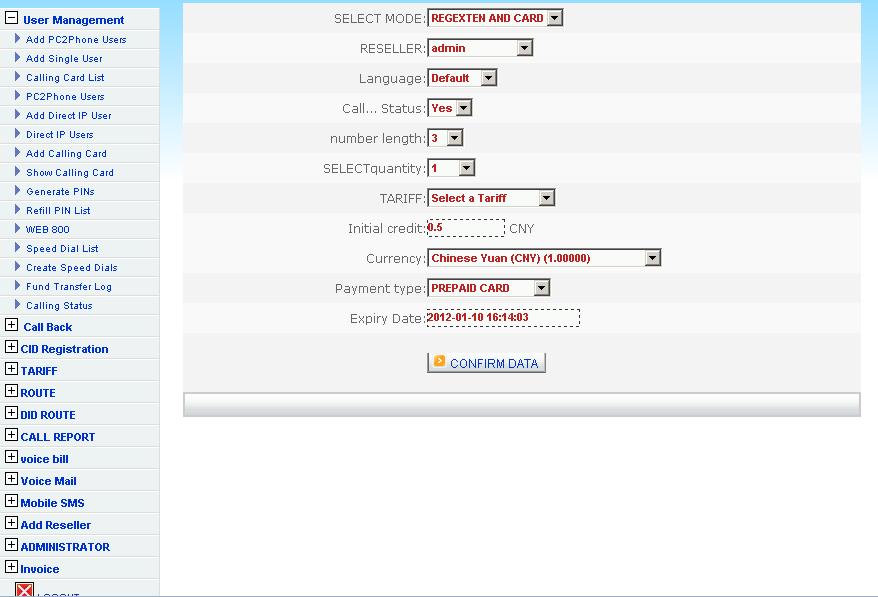

| Free stable accurate switch, Callcenter, IPPBX, Meeting, Voicemail, Voice SMS, ANI Callback, DNID, advertising, CID, mass system etc, support soft terminal agreement, H323, IAX2 SIP and MGCP, four agreement freely automatic conversion.. |

|

| Loan Calc is an easy-to-use tool intended to calculate loans and mortgages repayments in a very simple way. Loan Calc calculates repayments amount, monthly and total interest, total repayments and generates a full repayment list from a start date. Loan Calc is currency-independent so it can be used with Dollars, Francs, Marks, Pounds,...or whatever you like. Just use a dot or a comma for decimals depending on your system settings. Loan Calc lets you select both period and interest compounding from continuous (compounding only), weekly, biweekly, monthly, quarterly, semiannually and annualy. Furthermore Loan Calc allows you to save all the repayment list to a text file or an Excel sheet. ..

|

|

| Calculate your monthly repayment reduction and net position after refinancing.. |

|

| Calculating the repayments for your mortgage is a very important business. You have to get into a level that will allow you to keep up your repayments even if things don't go quite as well for you with regard to your personal finances as you might hope. Being able to see a layout of your full payment schedule for the entire length of your mortgage can be a huge help when deciding what level you are comfortable with.

The real mortgage news simple mortgage calculator will allow you to do just this. All you have to do is enter the anticipated price of your house, your deposit, interest rate and length of mortgage and the calculator will do the rest. This will allow you to see your full repayment schedule as you already know seeing something in print will give you a much clearer idea of whether you are heading in the right direction in terms all the level of repayment schedule that you are considering. If you wish to look at all the scenarios simply adjust any of the figures in the boxes and this will allow you to compare your repayment schedules in terms of burying the length, varying the deposit or considering houses in a slightly different price bracket.

Buying your own home is a massive financial undertaking so whether this is your first home or whether you are ready to upgrade the calculations you do now will be vital with regard to your financial future. We hope you enjoy this simple mortgage calculator. also, if you are not using a Windows-based operating system there are also calculators available at realmortgagenews.com that will work with virtually any other operating system...

|

|

| Calculates debt repayment period and interest assuming weekly interest.. |

|

| Before taking out a loan of any kind, it's very important to examine the repayment schedule and how that will impact upon you over the full term of the loan. You also need to look at this from the point of view of what might happen if you come under pressure in terms of your income. Nowhere is this more applicable than in the case of a line of credit where you use home equity to secure a lower interest rate.

If you've ever had any difficulty in the past which are credit rating than this type of loan where you secure the debt using the equity in your home can be a very attractive type of financial product. It's also very important to understand that if you default on the payments with this type of loan that you may finish up losing your home. That's why it's very important that you look at any of the problems that may arise before hand. If you have had difficulties which are credit rating in the past you need to ask yourself how you got into that situation and have things changed significantly since then.

That's why it's extremely important to be able to lay out the repayments and look at the different scenarios where you very the interest rate etc.

This calculator is extremely easy to use. It's also very easy to install. It will run on any existing version of Windows and is also been optimized to run on older computers to give the widest possible compatibility. All you have to do to use the calculator is input your loan amount, number of years and the interest rate. You will then be able to assess exactly what you're repayment schedule will be over the full term of your loan.

It's advisable to run several different sets of numbers as this will allow you to assess how a different interest-rate would affect the repayment schedule on an ongoing basis. Because this calculator runs very quickly it will allow you to go through several different sets of scenarios which will allow you to make the best decision possible...

|

|

| Calculate your home loan repayment and experiment with different options to reduce your total payment such as reducing years, increasing payment, once-off and irregular payments.. |

|

| Commercial lease agreement is used by a landlord to rent a commercial property to tenant.. |

|

| Credit-Repair-Planner helps create an credit-improvement-optimized repayment schedule. The concept is simple: pay the highest-interest cards first while bearing in mind that carrying over 50% on any credit line dings your credit score... |

|

| Credit-Repair-Planner helps create an credit-improvement-optimized repayment schedule. The concept is simple: pay the highest-interest cards first while bearing in mind that carrying over 50% on any credit line dings your credit score... |

|

Results in Tags For repayment agreement

| Business and Personal Legal Forms & Contracts including Bill of sale, power of attorney, lease agreements and notices, promissory note, release agreement, sales and contractor agreement, prenuptial agreement, last will & testament and living will... |

|

| Desktop Loan Repayment Calculator. Loan repayment calculation for your personal computer...

|

|

| Online Loan Repayment Calculator. Loan repayment calculation through web interface. No additional software instead of your web browser is required. You may use any browser you like: Internet Explorer, Mozilla Firefox etc. Simply enter the required values into the appropriate fields at the top and then press the button to calculate the repayment amount... |

|

| Calculate your home loan repayment and experiment with different options to reduce your total payment such as reducing years, increasing payment, once-off and irregular payments..

|

|

| Before taking out a loan of any kind, it's very important to examine the repayment schedule and how that will impact upon you over the full term of the loan. You also need to look at this from the point of view of what might happen if you come under pressure in terms of your income. Nowhere is this more applicable than in the case of a line of credit where you use home equity to secure a lower interest rate.

If you've ever had any difficulty in the past which are credit rating than this type of loan where you secure the debt using the equity in your home can be a very attractive type of financial product. It's also very important to understand that if you default on the payments with this type of loan that you may finish up losing your home. That's why it's very important that you look at any of the problems that may arise before hand. If you have had difficulties which are credit rating in the past you need to ask yourself how you got into that situation and have things changed significantly since then.

That's why it's extremely important to be able to lay out the repayments and look at the different scenarios where you very the interest rate etc.

This calculator is extremely easy to use. It's also very easy to install. It will run on any existing version of Windows and is also been optimized to run on older computers to give the widest possible compatibility. All you have to do to use the calculator is input your loan amount, number of years and the interest rate. You will then be able to assess exactly what you're repayment schedule will be over the full term of your loan.

It's advisable to run several different sets of numbers as this will allow you to assess how a different interest-rate would affect the repayment schedule on an ongoing basis. Because this calculator runs very quickly it will allow you to go through several different sets of scenarios which will allow you to make the best decision possible... |

|

| Contract Master offers 3200+ contract templates and samples which can protect your own interest best. It contains all the business and living contracts you could think of...

|

|

| The Budget Planner V3 Pro is a step ahead for home and personal budgeting. Equipped with a comprehensive online learning system, the budget planner runs on auto pilot, you simply add the details and the software will run your budget for you to learn from or live by! Features include a loan and mortgage calculator with 'what-if' multiple scenario planning. Using the compounded interest formula, where the interest is calculated on the monthly balance of the loan, the loan and mortgage calculator performs multiple queries based on your loan, loan term, interest rate and repayment options. Multiple Scenarios option: Based on three different scenarios on a static loan amount, this option allows you to view these scenarios based on varying interest rates and repayment options. Multiple Plan option: Based on the Multiple Scenarios option, this function allows you to have Plan A, Plan B, and Plan C. Each plan may have a different loan amount or you can choose to have the same repayments, loan term and interest rate, or vary all of these functions to provide you with 9 different scenarios. The loans and savings target goal tracker - How your loan affects your home finances. The Loan Tracker will automatically adjust your budget plan according to your loan requirements and repayment options. Savings Calculator and Savings Target Date - Have a target date for your next holiday or purchase? All you need to enter is how often you want to put money aside and the Savings Calculator automatically adjusts your budget for you and re-adjusts when you reach your target date. Due-dates and reminders chart - Add notes, reminders and due dates to your Income and Expense Items. Includes auto-notification facility, notes, reporting and graph modelling, internal web browser, context sensitive online help, auto store functionality and a fully customizable categories menu. Real budgeting, real returns!.. |

|

| A Residential Lease Agreement is used by a landlord to rent a rental property to a tenant. Also available is commercial lease agreement, sublease agreement and eviction notices... |

|

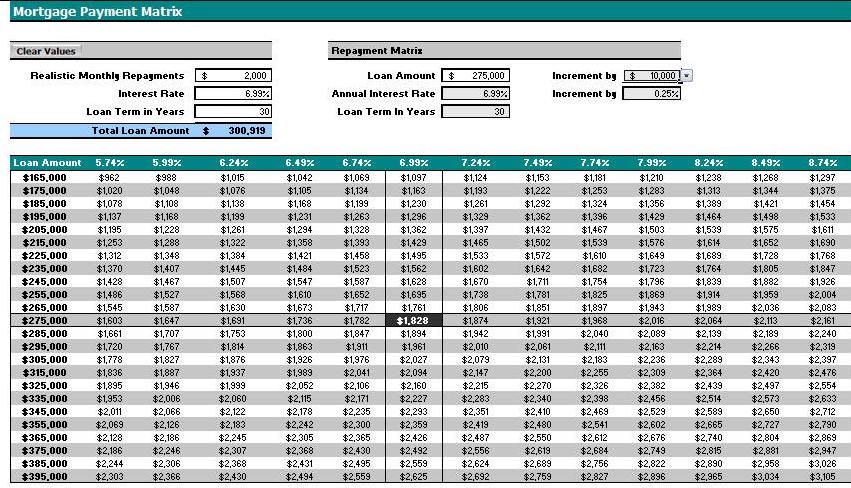

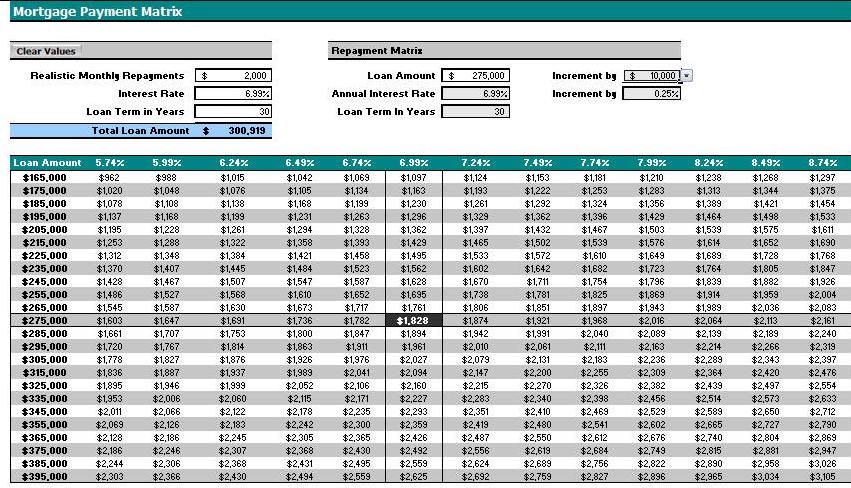

| Calculate your mortgage repayments and how much you can realistically borrow. Mortgage matrix that shows what your repayments will be if you borrowed more or less and changes in interest rates... |

|

| Calculates debt repayment period and interest assuming weekly interest.. |

|

Related search : oan repayment,loan repayment calculatordesktop loan repaymentloan repaymentrepayment calculatoronline loan,online loan repaymentloan repayment calculatorcalculator online loanrepayment calculator online,loan repayment gridinterest rateallow yourepaymOrder by Related

- New Release

- Rate

loan repayment grid -

buy let mortgage repayment -

mortgage repayment calculator -

401k loan repayment -

car loan repayment calculator -

|

|