|

|

Order by Related

- New Release

- Rate

Results in Title For desktop loan repayment

| Online Loan Repayment Calculator. Loan repayment calculation through web interface. No additional software instead of your web browser is required. You may use any browser you like: Internet Explorer, Mozilla Firefox etc. Simply enter the required values into the appropriate fields at the top and then press the button to calculate the repayment amount. .. |

|

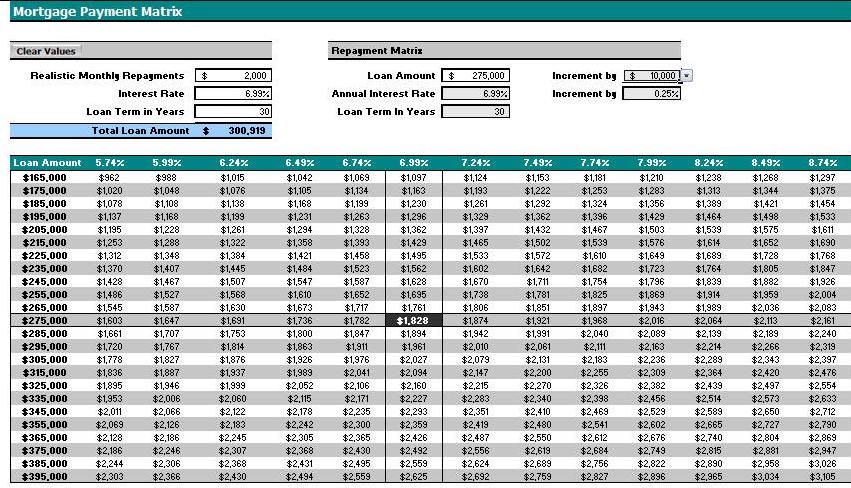

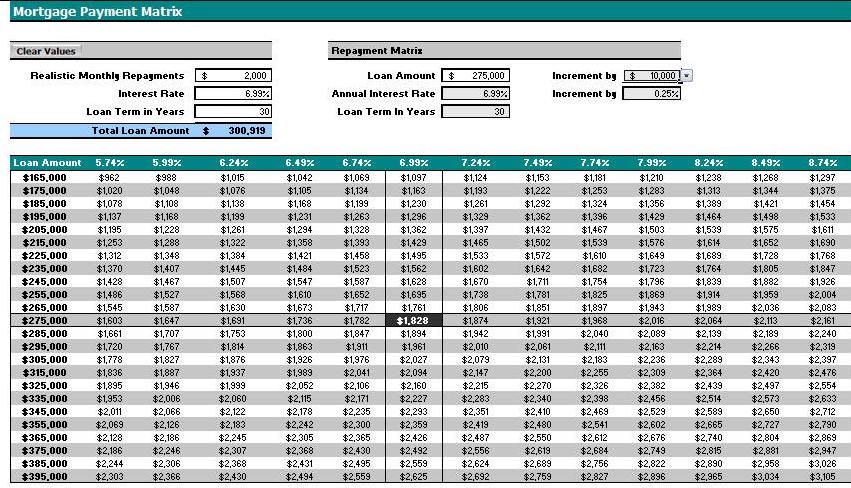

| Calculate your mortgage repayments and how much you can realistically borrow. Mortgage matrix that shows what your repayments will be if you borrowed more or less and changes in interest rates. ..

|

|

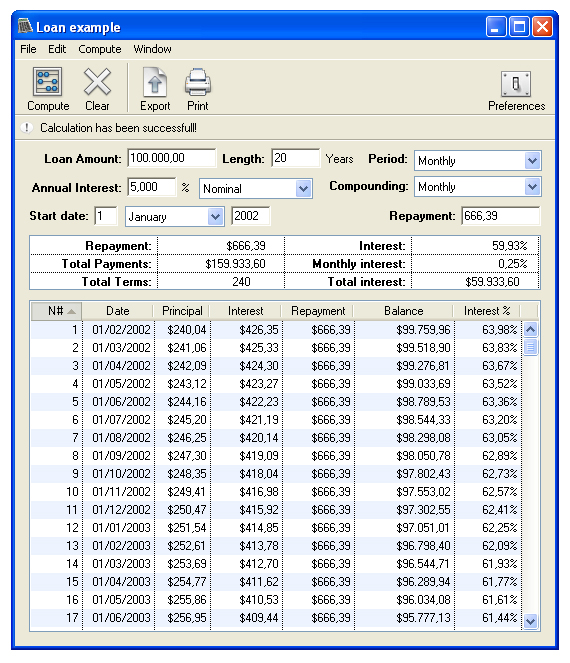

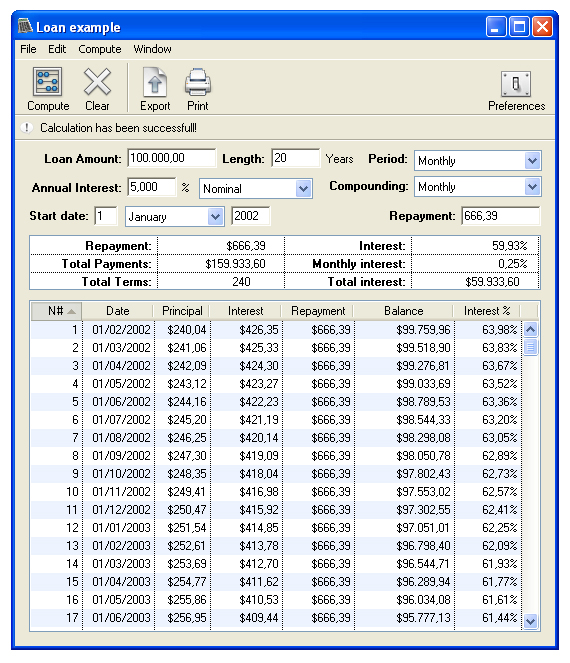

| Loan And Mortgage is a loan amortization schedule calculator that handles virtually any loan type. This program is user-friendly, flexible and loaded with useful features that show you where to recover or save money instantly! An absolute 'Must See!' .. |

|

| Loan Advisor is a powerful yet easy to use program that allows you to calculate, analyze and optimize your loan.

One of Loan Advisor's most useful features is the ability to demonstrate the effect of additional payments on your loan. By using this feature you can learn how to pay off your loan sooner and save money at the same time.

Loan Advisor also provides a detailed schedule of your loan over time. This allows you to see how each payment you make will affect your loan. You can see how much of each payment actually goes towards reducing capital and how much is just paying off interest.

The residual value calculator allows you to see the effects of leaving a residual value when paying back a loan. You just enter your loan details and you can then calculate the monthly payment required to leave a specified residual value. Alternatively you can calculate the residual value for any given monthly payment.

You can also perform "What If?" calculations on your loan. This means that you can calculate the loan amount, interest rate, period or repayment. Loan Advisor also includes a graph showing the breakdown in cost of your loan, and a loan grid showing interest rates and amounts around your loan so you can see the difference in loan payments.

Loan Advisor supports 8 different payment and compounding periods and can handle mortgage's paid in both arrears and advance. ..

|

|

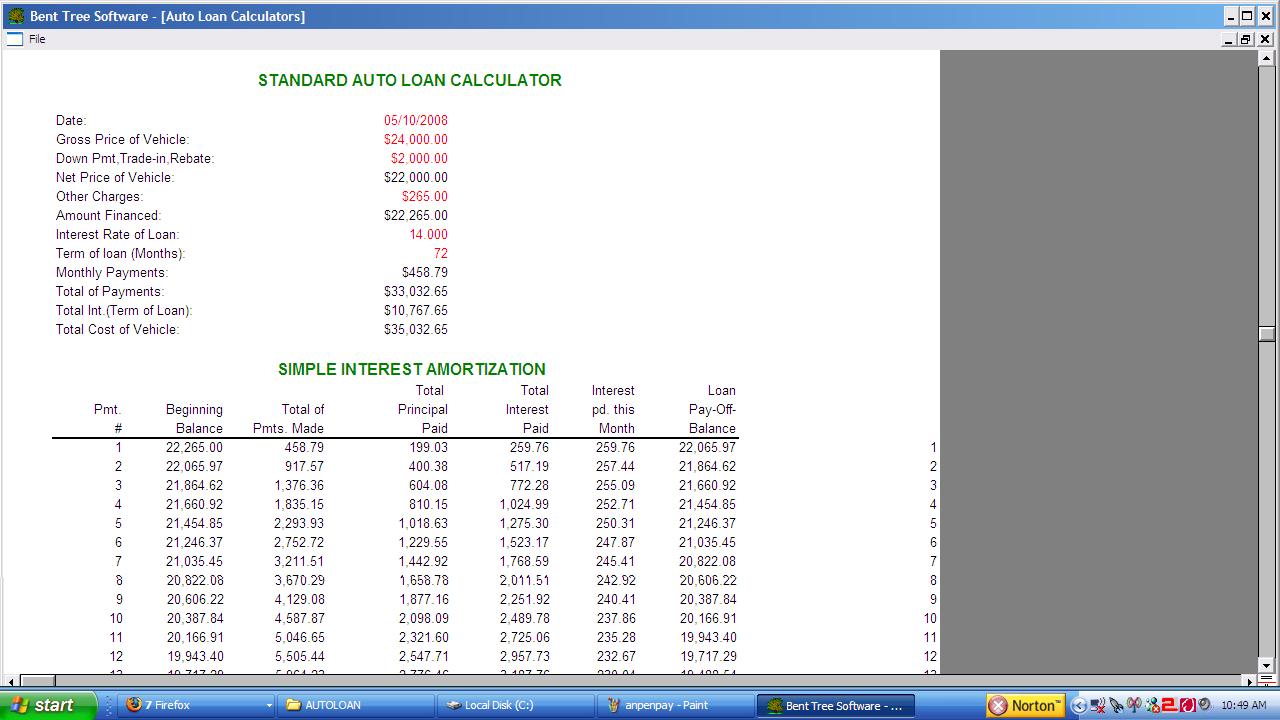

| This program is a version of a standard loan payment schedule that may be used for any type loan where simple interest is the type used. It is not limited to mortgage loans. It will run under Win 95, 98, Me, NT4,XP, & 2000. This program will calculate and print a complete amortization schedule for loans with any term from 1 to 30 years. The amount of interest paid during any calendar year is also calculated for your use at tax time.

Printouts are professional looking and may be used by financial planners as the program contains a "prepared by:" area and may also be useful to them in advising a client on this method of mortgage payment by demonstrating the effect this type of mortgage has on the term of the loan as well as the total amount of interest paid. .. |

|

| All purpose loan calculation program. Computes payments, amortization schedules, comparative analyses, refinancing, loan qualification. Has calculator function that computes any missing value - interest rate, term, payment. Shareware. $19.95. ..

|

|

| A free, fast, easy-to-use collection of 7 financial calculators. Support for Normal loans; Rule-of-78's; Canadian type loans; Points; 10 payment frequencies; 12 compounding frequencies; separate origination date and first payment dates .. |

|

| Internet Explorer Toolbar to help find UK low rate homeowner loans. The toolbar also contains RSS feeds from key UK loan websites. Easily find low rate homeowner loans if you need a .. |

|

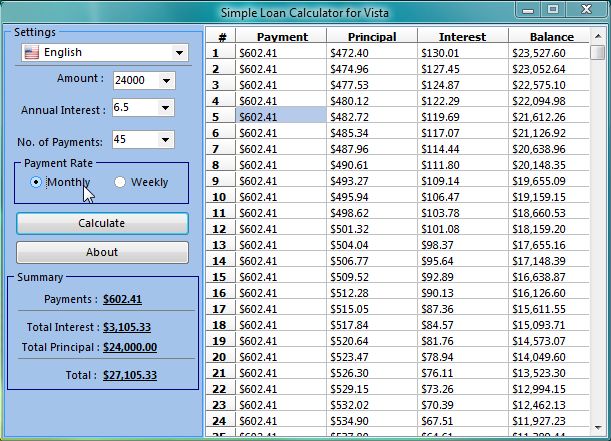

| 4 advanced financial calculators in one program. Loan calculator - enter loan amount, number of payments and interest rate and get monthly payment , total amount paid and total interest. Simple and advanced mortgage calculators , auto loan calculator .. |

|

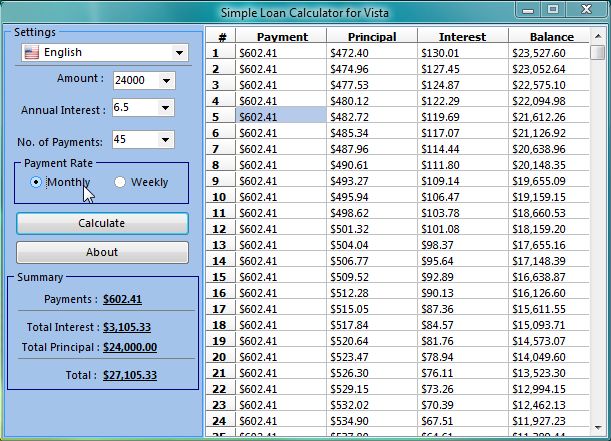

| Simple loan calculator is an easy-to-use tool intended to calculate loans and mortgages repayments in a very simple way. It calculates repayments amount, monthly and total interest, and more. .. |

|

Results in Keywords For desktop loan repayment

| Credit-Repair-Planner helps create an credit-improvement-optimized repayment schedule. The concept is simple: pay the highest-interest cards first while bearing in mind that carrying over 50% on any credit line dings your credit score... |

|

| Calculating the repayments for your mortgage is a very important business. You have to get into a level that will allow you to keep up your repayments even if things don't go quite as well for you with regard to your personal finances as you might hope. Being able to see a layout of your full payment schedule for the entire length of your mortgage can be a huge help when deciding what level you are comfortable with.

The real mortgage news simple mortgage calculator will allow you to do just this. All you have to do is enter the anticipated price of your house, your deposit, interest rate and length of mortgage and the calculator will do the rest. This will allow you to see your full repayment schedule as you already know seeing something in print will give you a much clearer idea of whether you are heading in the right direction in terms all the level of repayment schedule that you are considering. If you wish to look at all the scenarios simply adjust any of the figures in the boxes and this will allow you to compare your repayment schedules in terms of burying the length, varying the deposit or considering houses in a slightly different price bracket.

Buying your own home is a massive financial undertaking so whether this is your first home or whether you are ready to upgrade the calculations you do now will be vital with regard to your financial future. We hope you enjoy this simple mortgage calculator. also, if you are not using a Windows-based operating system there are also calculators available at realmortgagenews.com that will work with virtually any other operating system...

|

|

| Before taking out a loan of any kind, it's very important to examine the repayment schedule and how that will impact upon you over the full term of the loan. You also need to look at this from the point of view of what might happen if you come under pressure in terms of your income. Nowhere is this more applicable than in the case of a line of credit where you use home equity to secure a lower interest rate.

If you've ever had any difficulty in the past which are credit rating than this type of loan where you secure the debt using the equity in your home can be a very attractive type of financial product. It's also very important to understand that if you default on the payments with this type of loan that you may finish up losing your home. That's why it's very important that you look at any of the problems that may arise before hand. If you have had difficulties which are credit rating in the past you need to ask yourself how you got into that situation and have things changed significantly since then.

That's why it's extremely important to be able to lay out the repayments and look at the different scenarios where you very the interest rate etc.

This calculator is extremely easy to use. It's also very easy to install. It will run on any existing version of Windows and is also been optimized to run on older computers to give the widest possible compatibility. All you have to do to use the calculator is input your loan amount, number of years and the interest rate. You will then be able to assess exactly what you're repayment schedule will be over the full term of your loan.

It's advisable to run several different sets of numbers as this will allow you to assess how a different interest-rate would affect the repayment schedule on an ongoing basis. Because this calculator runs very quickly it will allow you to go through several different sets of scenarios which will allow you to make the best decision possible... |

|

| The Budget Planner V3 Pro is a step ahead for home and personal budgeting. Equipped with a comprehensive online learning system, the budget planner runs on auto pilot, you simply add the details and the software will run your budget for you to learn from or live by! Features include a loan and mortgage calculator with 'what-if' multiple scenario planning. Using the compounded interest formula, where the interest is calculated on the monthly balance of the loan, the loan and mortgage calculator performs multiple queries based on your loan, loan term, interest rate and repayment options. Multiple Scenarios option: Based on three different scenarios on a static loan amount, this option allows you to view these scenarios based on varying interest rates and repayment options. Multiple Plan option: Based on the Multiple Scenarios option, this function allows you to have Plan A, Plan B, and Plan C. Each plan may have a different loan amount or you can choose to have the same repayments, loan term and interest rate, or vary all of these functions to provide you with 9 different scenarios. The loans and savings target goal tracker - How your loan affects your home finances. The Loan Tracker will automatically adjust your budget plan according to your loan requirements and repayment options. Savings Calculator and Savings Target Date - Have a target date for your next holiday or purchase? All you need to enter is how often you want to put money aside and the Savings Calculator automatically adjusts your budget for you and re-adjusts when you reach your target date. Due-dates and reminders chart - Add notes, reminders and due dates to your Income and Expense Items. Includes auto-notification facility, notes, reporting and graph modelling, internal web browser, context sensitive online help, auto store functionality and a fully customizable categories menu. Real budgeting, real returns!..

|

|

| Convert a desktop PC into a secure, managed network device that achieves all the benefits of thin client computing while prolonging the useful life of existing desktops... |

|

| Active Desktop Calendar is unique PIM that shows valuable data directly on desktop. Audio Notes Recorder records voice notes or simply any sound coming through your sound card. Active Desktop Wallpaper keeps your desktop always looking fresh...

|

|

| T5 is an innovative program that changes your Desktop and/or Toolbar Wallpaper automatically at intervals of every Hour, Day, Week or Month. Now capable of using bmp, gif and jpg images for the Desktop and the Toolbars of Internet Explorer, Outlook Express and all Windows folders, the first program to do so. It also had the option to remove the colored block behind the text of the Desktop Icons, change the text fore color and adds your own caption to the Title Bar of Internet Explorer. Comes with 3 matching Wallpaper sets. .. |

|

Results in Description For desktop loan repayment

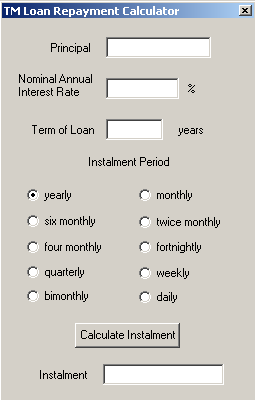

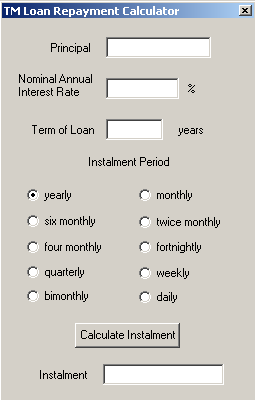

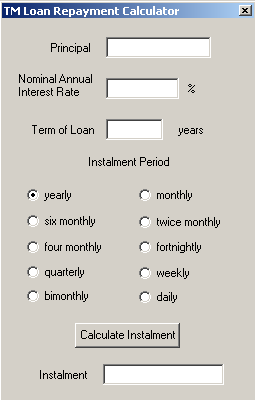

| Desktop Loan Repayment Calculator. Loan repayment calculation for your personal computer... |

|

| Online Loan Repayment Calculator. Loan repayment calculation through web interface. No additional software instead of your web browser is required. You may use any browser you like: Internet Explorer, Mozilla Firefox etc. Simply enter the required values into the appropriate fields at the top and then press the button to calculate the repayment amount...

|

|

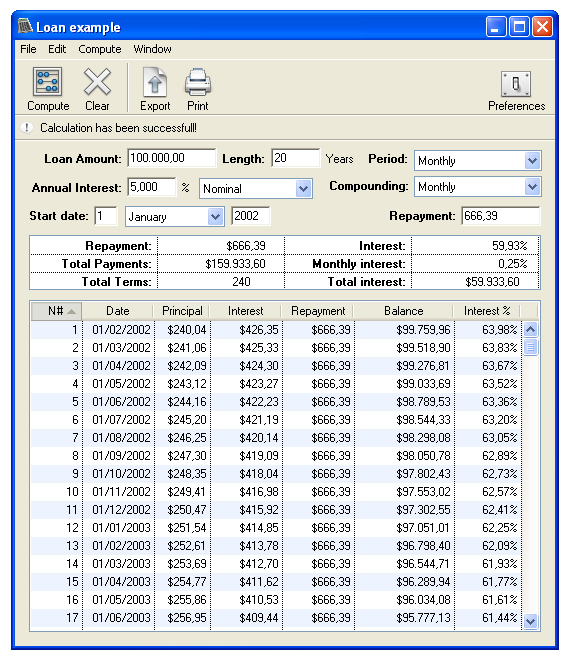

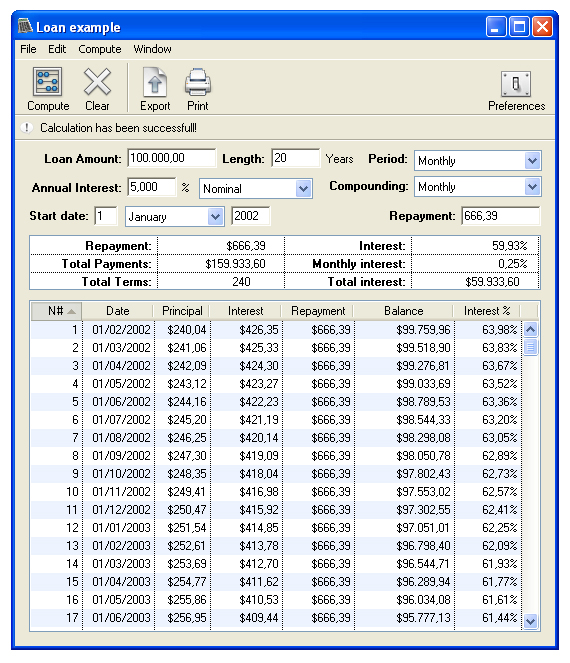

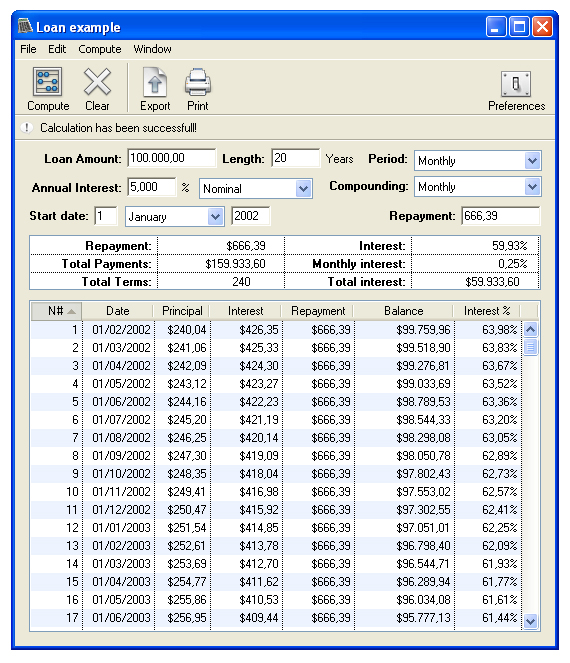

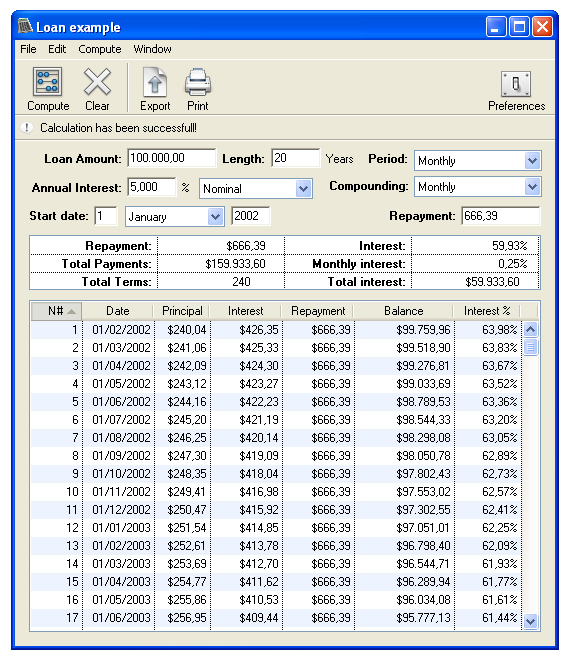

| Loan Calc is an easy-to-use tool intended to calculate loans and mortgages repayments in a very simple way. Loan Calc calculates repayments amount, monthly and total interest, total repayments and generates a full repayment list from a start date. Loan Calc is currency-independent so it can be used with Dollars, Francs, Marks, Pounds,...or whatever you like. Just use a dot or a comma for decimals depending on your system settings. Loan Calc lets you select both period and interest compounding from continuous (compounding only), weekly, biweekly, monthly, quarterly, semiannually and annualy. Furthermore Loan Calc allows you to save all the repayment list to a text file or an Excel sheet. .. |

|

| TM Desktop Utilities Pack. Includes 3 freeware utilities: Desktop Metric Conversion Calculator, Desktop Loan Repayment Calculator, Desktop Credit Card Validator in one program. All of them have an intuitive interface and simple to learn and use...

|

|

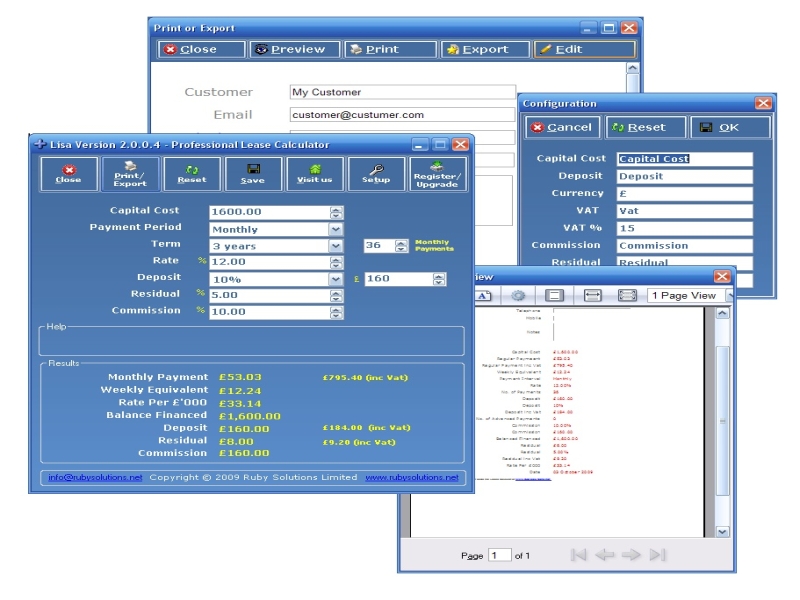

| Loan Advisor is a powerful yet easy to use program that allows you to calculate, analyze and optimize your loan.

One of Loan Advisor's most useful features is the ability to demonstrate the effect of additional payments on your loan. By using this feature you can learn how to pay off your loan sooner and save money at the same time.

Loan Advisor also provides a detailed schedule of your loan over time. This allows you to see how each payment you make will affect your loan. You can see how much of each payment actually goes towards reducing capital and how much is just paying off interest.

The residual value calculator allows you to see the effects of leaving a residual value when paying back a loan. You just enter your loan details and you can then calculate the monthly payment required to leave a specified residual value. Alternatively you can calculate the residual value for any given monthly payment.

You can also perform "What If?" calculations on your loan. This means that you can calculate the loan amount, interest rate, period or repayment. Loan Advisor also includes a graph showing the breakdown in cost of your loan, and a loan grid showing interest rates and amounts around your loan so you can see the difference in loan payments.

Loan Advisor supports 8 different payment and compounding periods and can handle mortgage's paid in both arrears and advance... |

|

| Loan Calc is an easy-to-use tool intended to calculate loans and mortgages repayments in a very simple way. Loan Calc calculates repayments amount, monthly and total interest, total repayments and generates a full repayment list from a start date. Loan Calc is currency-independent so it can be used with Dollars, Francs, Marks, Pounds,...or whatever you like. Just use a dot or a comma for decimals depending on your system settings. Loan Calc lets..

|

|

| Before taking out a loan of any kind, it's very important to examine the repayment schedule and how that will impact upon you over the full term of the loan. You also need to look at this from the point of view of what might happen if you come under pressure in terms of your income. Nowhere is this more applicable than in the case of a line of credit where you use home equity to secure a lower interest rate.

If you've ever had any difficulty in the past which are credit rating than this type of loan where you secure the debt using the equity in your home can be a very attractive type of financial product. It's also very important to understand that if you default on the payments with this type of loan that you may finish up losing your home. That's why it's very important that you look at any of the problems that may arise before hand. If you have had difficulties which are credit rating in the past you need to ask yourself how you got into that situation and have things changed significantly since then.

That's why it's extremely important to be able to lay out the repayments and look at the different scenarios where you very the interest rate etc.

This calculator is extremely easy to use. It's also very easy to install. It will run on any existing version of Windows and is also been optimized to run on older computers to give the widest possible compatibility. All you have to do to use the calculator is input your loan amount, number of years and the interest rate. You will then be able to assess exactly what you're repayment schedule will be over the full term of your loan.

It's advisable to run several different sets of numbers as this will allow you to assess how a different interest-rate would affect the repayment schedule on an ongoing basis. Because this calculator runs very quickly it will allow you to go through several different sets of scenarios which will allow you to make the best decision possible... |

|

| The Budget Planner V3 Pro is a step ahead for home and personal budgeting. Equipped with a comprehensive online learning system, the budget planner runs on auto pilot, you simply add the details and the software will run your budget for you to learn from or live by! Features include a loan and mortgage calculator with 'what-if' multiple scenario planning. Using the compounded interest formula, where the interest is calculated on the monthly balance of the loan, the loan and mortgage calculator performs multiple queries based on your loan, loan term, interest rate and repayment options. Multiple Scenarios option: Based on three different scenarios on a static loan amount, this option allows you to view these scenarios based on varying interest rates and repayment options. Multiple Plan option: Based on the Multiple Scenarios option, this function allows you to have Plan A, Plan B, and Plan C. Each plan may have a different loan amount or you can choose to have the same repayments, loan term and interest rate, or vary all of these functions to provide you with 9 different scenarios. The loans and savings target goal tracker - How your loan affects your home finances. The Loan Tracker will automatically adjust your budget plan according to your loan requirements and repayment options. Savings Calculator and Savings Target Date - Have a target date for your next holiday or purchase? All you need to enter is how often you want to put money aside and the Savings Calculator automatically adjusts your budget for you and re-adjusts when you reach your target date. Due-dates and reminders chart - Add notes, reminders and due dates to your Income and Expense Items. Includes auto-notification facility, notes, reporting and graph modelling, internal web browser, context sensitive online help, auto store functionality and a fully customizable categories menu. Real budgeting, real returns!.. |

|

| Loan Calc is an easy-to-use tool intended to calculate loans and mortgages repayments in a very simple way. Loan Calc calculates repayments amount, monthly and total interest, total repayments and generates a full repayment list from a start date... |

|

| Loan Advisor for Excel is a special loan toolbox with many loan calculators for users who need a tool to establish and compare different loan options. This powerful set of calculators will help you in many loan calculations and determine the better loan for you... |

|

Results in Tags For desktop loan repayment

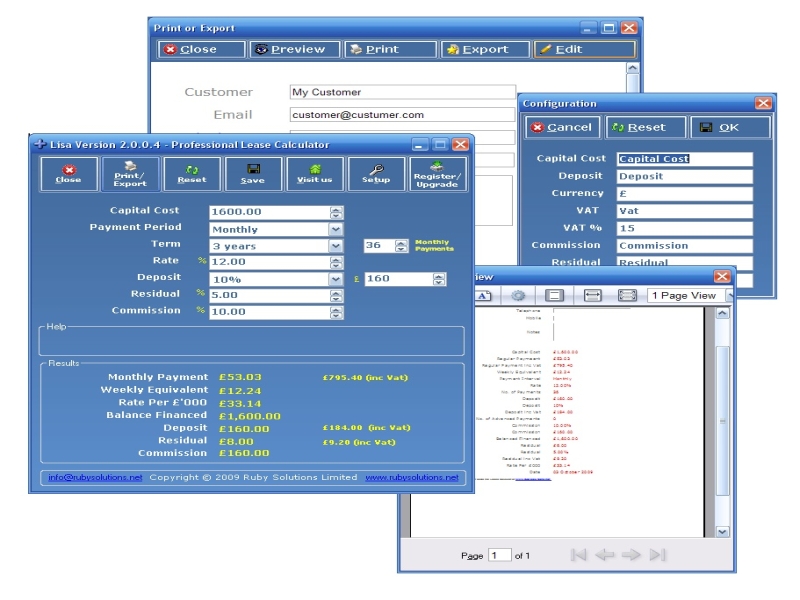

| Free Lease finance calculator for the Leasing Professional. Simple to use, but comprehensive, Lisa is an excellent tool for quoting rapid and accurate lease finance repayments. Speeds up the routine and simplifies the more complex lease calculations.. |

|

| Mrtgcalc is an easy-to-use loan calculator allowing users to analyse and manage all types of loans including but not restricted to mortgage loans, home loans, auto car lease loans and student loans. Mrtgcalc supports lease loans and includes the much-awaited Loan Amount calculator, Interest Rate calculator, and Loan Term calculator alongside the popular Monthly Payment calculator.

Users can enter, edit and store unlimited numbers of loan calculations. For each loan, Mrtgcalc will show the Monthly Payment, the Cost of Loan and a full Amortization breakdown detailing the Capital Paid, Interest Paid, Outstanding Loan Balance, Total Capital to date and Total Interest Paid to date for each month, whilst allowing capital repayment scenarios to be entered and providing save/restore facilities.

Other FIS Windows CE Products include:-

1) Genesis - Technical Analysis & Charting System,

2) PortMgr - Investment Portfolio Manager,

3) pFXcalc - Currency Calculator,

4) Optcalc - Options Calculator,

5) Futcalc - Futures Calculator.

This version supports Pocket PC, Pocket PC 2002 and Pocket PC 2003 devices. For further information and free trial versions for other CE devices, such as Handheld PC & HPC 2000, please visit:-

www.fis-group.com/palmtop.htm..

|

|

| Loan Advisor is a powerful yet easy to use program that allows you to calculate, analyze and optimize your loan.

One of Loan Advisor's most useful features is the ability to demonstrate the effect of additional payments on your loan. By using this feature you can learn how to pay off your loan sooner and save money at the same time.

Loan Advisor also provides a detailed schedule of your loan over time. This allows you to see how each payment you make will affect your loan. You can see how much of each payment actually goes towards reducing capital and how much is just paying off interest.

The residual value calculator allows you to see the effects of leaving a residual value when paying back a loan. You just enter your loan details and you can then calculate the monthly payment required to leave a specified residual value. Alternatively you can calculate the residual value for any given monthly payment.

You can also perform "What If?" calculations on your loan. This means that you can calculate the loan amount, interest rate, period or repayment. Loan Advisor also includes a graph showing the breakdown in cost of your loan, and a loan grid showing interest rates and amounts around your loan so you can see the difference in loan payments.

Loan Advisor supports 8 different payment and compounding periods and can handle mortgage's paid in both arrears and advance... |

|

| Loan And Mortgage is a loan amortization schedule calculator that handles virtually any loan type. This program is user-friendly, flexible and loaded with useful features that show you where to recover or save money instantly! An absolute 'Must See!'..

|

|

| Desktop Loan Repayment Calculator. Loan repayment calculation for your personal computer... |

|

| All purpose loan calculation program. Computes payments, amortization schedules, comparative analyses, refinancing, loan qualification. Has calculator function that computes any missing value - interest rate, term, payment. Shareware. $19.95...

|

|

| Loan and mortgage amortization tracking tool suitable for business use. Can also be very useful in any household with active loans. It also accommodates actual date and payment amount tracking. Fiscal year selection and manual amortization.. |

|

| How much house can you afford? You might be pleasantly surprised.

This program is a version of a loan qualifier for either a fixed rate or a variable rate mortgage. It will run under Win 95, 98, Me, NT4, XP, & 2000. This program uses the same "ratios" method used by your "friendly banker" to determine how large either a fixed rate or variable rate mortgage you can expect approval for. Principal, interest, homeowners' insurance, and taxes (PITI) are included in the analysis. Printouts are professional looking and may be used by financial planners as the program contains a "prepared by:"

area. The program may also be useful to small mortgage lenders to pre-

qualify potential borrowers. For the potential home purchaser, the program quickly shows them how much house they can afford based on income, and existing indebtedness... |

|

| Confused by all the "hype" about rebates, low interest loans, or "Rule of 78" versus simple interest loans? This program includes most of the current types of financing available for automobile loans... |

|

| Did you ever think of nice-looking clock on your desktop? Please take a look at the screenshot to see what kind of clocks you will have. ClockWallpaper - clock and wallpaper for Desktop. This alarm clock sits on your desktop as wallpaper... |

|

Related search : loan advisorresidual valuecalculate theallows you,loan advisor alsoadvisor loan advisorloan advisor loanensuing resultsloan and,ensuing results abilityloan repayment,loan repayment calculatordesktop loan repayment,amortization scheduleenterprise editOrder by Related

- New Release

- Rate

nelnet com repayment -

repayment period -

debt repayment plans -

buy let mortgage repayment -

mortgage repayment calculator -

|

|